Term Loans

Understanding Term Loans: A Simple Guide for Business Owners

What is a Term Loan?

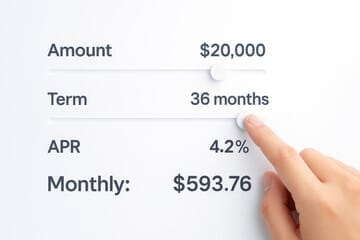

A term loan is a type of loan where you borrow a lump sum of money upfront and pay it back over a set period of time, typically in monthly payments. This is similar to loans you might have had for things like a car or a mortgage, where the loan is paid off over a specific term—usually measured in years.

Term loans are often used to make large purchases that benefit the business long-term, such as buying equipment, machinery, or even real estate. A key feature of term loans is that they can either have fixed or variable interest rates, and they may require collateral (something valuable you pledge to secure the loan, like the equipment you're buying).

How Do Term Loans Work?

When you take out a term loan, you agree to a set repayment schedule. Here’s how it works:

Monthly Payments: Each month, you’ll make payments that cover both the interest on the loan and a portion of the original amount borrowed (the principal).

Collateral: Many term loans are secured by the item you're purchasing, like equipment or real estate. If you don’t repay the loan, the lender can take possession of the collateral.

Fees: Be prepared to pay fees when taking out the loan. These could include closing fees, insurance, and sometimes additional charges for late payments. Make sure to ask your lender about these upfront.

Types of Term Loans

Term loans are often used to finance big-ticket purchases. Here are some common examples:

Equipment: A small business may need a term loan to buy expensive equipment, such as a new oven for a restaurant or machines for a manufacturing company.

Inventory: If you need to quickly stock up on inventory to meet demand, a term loan can help cover the costs without draining your cash flow.

Real Estate: Whether you're buying a building, renovating an office, or leasing property, a term loan can provide the funds to make it happen.

Advantages and Disadvantages of Term Loans

Like any financial tool, term loans have their pros and cons:

Pros:

Quick Access to Funds: You can get the money you need for large purchases right away.

Lower Interest Rates: Compared to credit cards, term loans usually come with lower interest rates.

Build Your Credit: Making on-time payments can improve your business credit score.

Cons:

Impact on Credit: If you miss payments, it can harm your business credit score.

Long Approval Process: Term loans can take longer to get approved compared to other types of loans.

Late Payment Penalties: Missing a payment can lead to extra fees.

Interest Rates and Fees

The interest rate you pay on a term loan can be fixed or variable:

Fixed-rate loans: The interest rate stays the same throughout the life of the loan, making it easier to plan your monthly payments.

Variable-rate loans: The rate changes based on market conditions, so it can go up or down over time. This could mean lower rates early on but higher payments later.

You may also have to pay other fees, such as a loan origination fee or closing costs.

How to Apply for a Term Loan

To apply for a term loan, you’ll need to provide information about your business, such as:

A detailed business plan showing why you need the loan.

Financial statements (like income statements and balance sheets) for the past few years.

Personal financial information for the business owners.

Information about the asset you plan to buy with the loan (like a copy of the purchase agreement).

Lenders will review your credit, both business and personal, before deciding whether to approve your loan.

What to Know Before Signing

Before agreeing to a term loan, make sure you fully understand the terms. This includes:

Interest Rates: Understand whether your loan has a fixed or variable rate.

Penalties: Check if there are fees for late payments or early loan repayment.

Loan Terms: Ask if you can pay off the loan early without extra charges or if you’ll be hit with a penalty.

If you're not sure about any part of the loan agreement, it might be helpful to consult a financial advisor or lawyer.

Why Take Out a Term Loan?

Term loans are a good option when you need financing for larger purchases, such as:

Equipment or machinery for your business

Technology and office supplies

Buying real estate or expanding your business space

While credit cards or lines of credit might be better for everyday expenses, term loans are ideal for bigger investments that your business will benefit from for years to come.

Who Offers Term Loans?

You can get term loans from a variety of lenders, including:

Banks: Commercial banks and credit unions often offer term loans.

Non-bank Lenders: These include online lenders or specialized finance companies.

Manufacturers: Some equipment or vehicle manufacturers offer financing options through their own lending divisions.

In Conclusion

Term loans are a great way to finance big purchases that will help your business grow. While they come with certain fees and responsibilities, they can be a better option than using credit cards or draining your cash reserves. Before applying, make sure to do your research, compare interest rates, and understand the loan terms so you can make the best decision for your business.

Disclaimer: * The 0% is for a limited period of time, your initial time period and final rate will be based on your qualifications and program offerings at time of application and approval. All programs are subject to change without notice. Submitting your business funding application will not impact your personal credit score. However, if you choose to proceed with an offer, certain funding options may require a hard credit inquiry. ChicagoBusinessLoans.com is not a direct lender and does not make credit decisions. Approvals are not guaranteed and are subject to bank/issuer decision. We do not provide legal, tax, or financial advice. Please consult a licensed professional for personalized guidance.

Leave your email and we will contact you in 24 hours